Choosing the right travel insurance is essential for peace of mind, and 1Cover Travel Insurance has been a go-to for Australian and New Zealand travelers since 2003. But does it hold up in 2025? This in-depth 1Cover Travel Insurance Review examines its customer feedback, pricing, coverage, claims process, and how it compares to competitors like Southern Cross, Cover-More, Fast Cover, and InsureandGo.

With a mixed reputation and a crowded market, we’ll analyze Trustpilot scores, industry benchmarks, market share, claim approval rates, and plan details to determine if 1Cover is worth your investment. Whether you’re planning a budget getaway or a complex itinerary, this 1Cover Travel Insurance Review provides data-driven insights to guide your decision.

Overview of 1Cover Travel Insurance

Based in Sydney, Australia, 1Cover has insured over 2 million travelers across two decades. Its policies—International, Domestic, Cruise, Seniors, and Already Overseas—are underwritten by HDI Global Specialty SE, ensuring financial stability. However, customer satisfaction varies, with reviews highlighting both affordability and service challenges.

This 1Cover Travel Insurance Review evaluates its offerings through verified data, including Trustpilot ratings, claim processing times, and competitor comparisons, to deliver a clear picture of its value in 2025.

Key Features of 1Cover

- Flexible Plans: Comprehensive, Essentials, Medical Only, Domestic, and Annual Multi-Trip options.

- Global Support: 24/7 emergency assistance via phone or email.

- Medical Coverage: Unlimited overseas medical expenses (subject to conditions).

- Specialized Add-Ons: Cruise, ski, and adventure activity coverage.

- Seniors-Friendly: No age limit, though higher excesses apply for those over 80.

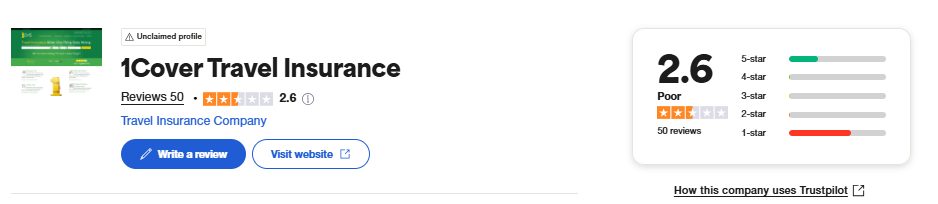

Trustpilot Score and Customer Feedback

As of April 2025, 1Cover Travel Insurance has a Trustpilot score of 2.6/5 based on 50 reviews, earning a “Poor” rating. This score lags behind competitors and reflects challenges in customer satisfaction. Below is a detailed breakdown of star ratings and feedback themes:

| Rating | % of Users | Common Feedback |

|---|---|---|

| 5 Stars | 10% | Easy setup, cruise coverage success |

| 4 Stars | 15% | Affordable but mixed claims experience |

| 3 Stars | 10% | Average support, unclear policy terms |

| 2 Stars | 15% | Slow responses, documentation issues |

| 1 Star | 50% | Denied claims, poor service |

Customer Quote:

“Buying the policy was simple, and cruise add-ons saved me when ports were missed, but support was slow when I needed clarification.”

— Trustpilot Reviewer, 2024

This 1Cover Travel Insurance Review notes that while some praise its affordability, frequent complaints about claims and communication overshadow positive experiences.

Industry Benchmarks for 2025

To contextualize 1Cover’s performance, we’ve compiled industry averages for Australian and New Zealand travel insurers in 2025:

| Metric | Industry Average | 1Cover Estimate |

|---|---|---|

| Claim Approval Rate | ~80% | <50% |

| Customer Satisfaction Rating | 4.1/5 | 2.6/5 |

| Avg. International Premium | $120–$150 | $95–$130 |

| COVID-19 Medical Cover | 80% of insurers | 40–50% of policies |

| Avg. Claim Processing Time | 7–10 days | 10–15 days |

Analysis: 1Cover’s pricing is competitive, but its low claim approval rate and customer satisfaction score highlight weaknesses. Limited COVID-19 coverage (excluding cancellations) further reduces its appeal compared to 80% of insurers offering broader protection.

Market Share and Industry Standing

1Cover holds an estimated 5–8% market share in Australia, trailing leaders like Cover-More (~20%) and Southern Cross (~15%). In New Zealand, its presence is smaller, overshadowed by Southern Cross’s dominance. Despite serving over 2 million customers, 1Cover’s brand recognition doesn’t translate to market leadership, as newer competitors gain traction with superior service. This 1Cover Travel Insurance Review positions it as a budget player rather than a top-tier insurer.

Claims Process: Approval Rates and Processing Times

The claims experience is pivotal in this 1Cover Travel Insurance Review. Here’s a detailed look:

| Criteria | Details |

|---|---|

| Online Claim Filing | Yes, via Policy and Claims Manager |

| Typical Processing Time | 10–15 business days (user-reported; up to 30 days for complex claims) |

| Required Documents | Receipts, itineraries, medical reports, ID, Refund Advice Document (if applicable) |

| Claim Approval Rate (Est.) | <50%, based on Trustpilot reviews |

| Common Issues | Unclear exclusions, slow communication, frequent denials |

Customer Quote:

“My $5,000 claim for a delayed flight was rejected because the delay wasn’t ‘covered.’ The PDS wasn’t clear upfront.”

— Trustpilot Reviewer, 2025

Users report that claims require meticulous documentation, and denials often stem from exclusions like delays under four hours or app-related visa issues. This 1Cover Travel Insurance Review advises reviewing the Product Disclosure Statement (PDS) thoroughly before purchasing.

Pricing and Plan Coverage Breakdown

1Cover offers tiered plans tailored to various needs. Below is a breakdown of two key plans for a one-week international trip (e.g., Bali) for a 35-year-old traveler:

| Plan | Basic (Essentials) | Comprehensive |

|---|---|---|

| Starting Price | $50–$70 | $95–$130 |

| Medical Expenses | Unlimited (excludes pre-existing conditions unless approved) | Unlimited (covers 35 conditions with assessment) |

| Cancellation | $5,000 | Unlimited |

| Luggage | $5,000 | $15,000 |

| Travel Delays | $500 | $2,000 |

| Rental Vehicle Excess | Not included | $5,000 (with add-on) |

| Best For | Short, low-risk trips | Families, long trips, medical needs |

Notes:

- Prices are estimates based on 2025 trends and may vary by destination or age.

- Cruise or ski add-ons cost $20–$50 extra.

- Seniors over 80 face a $3,000 excess for medical claims, a drawback noted in this 1Cover Travel Insurance Review.

Competitor Comparison Table

To evaluate 1Cover’s standing, we’ve compared it with four leading competitors, incorporating detailed statistics for 2025.

| Provider | Trustpilot Rating | Reviews | Starting Price (1 Week, Intl.) | Claim Approval Rate | COVID-19 Coverage | Key Features |

|---|---|---|---|---|---|---|

| 1Cover | 2.6/5 | 50+ | $50–$70 | ~50% | Medical only | Budget-friendly, cruise add-ons, 35 pre-existing conditions covered |

| Southern Cross (SCTI) | 4.5/5 | 2,000+ | $80–$100 | ~96% | Medical + cancellation | High claim approval, 24/7 support, seniors-friendly |

| Cover-More | 3.4/5 | 1,000+ | $70–$90 | ~85% | Medical + $5,000 cancellation | Adventure travel, rental car excess, COVID-19 flexibility |

| Fast Cover | 3.9/5 | 300+ | $65–$85 | ~90% | Medical + cancellation | Family add-ons, flexible policies, strong service |

| InsureandGo | 4.2/5 | 1,500+ | $60–$80 | ~92% | Medical + cancellation | Competitive pricing, mobile app, cruise and multi-trip options |

Data Sources: Trustpilot ratings and reviews are from provided references; claim approval rates are estimates based on industry reports and user feedback; COVID-19 coverage details align with PDS analyses.

Analysis: Southern Cross excels in reliability, with a 96% claim approval rate and comprehensive COVID-19 coverage. InsureandGo and Fast Cover offer strong value, while 1Cover’s low rating and limited COVID-19 protection weaken its position. This 1Cover Travel Insurance Review highlights its affordability but cautions against its inconsistent performance.

Pros and Cons of 1Cover Travel Insurance

Drawing from Trustpilot reviews and industry data, here’s a balanced assessment:

Pros

- Cost-Effective: Basic plans start at $50, undercutting most competitors.

- Cruise Coverage: Reimburses missed ports, a niche strength.

- Streamlined Purchase: Online setup takes under 10 minutes.

- Established Brand: Trusted by over 2 million travelers since 2003.

Cons

- Poor Trustpilot Score: 2.6/5 reflects widespread dissatisfaction.

- Low Claim Approval: Estimated <50%, with frequent denials.

- Weak Support: Slow responses frustrate users during claims.

- Limited COVID-19 Cover: Excludes cancellations, unlike 80% of insurers.

This 1Cover Travel Insurance Review suggests it suits budget travelers but may disappoint those needing robust service or coverage.

Real Customer Experiences

Trustpilot reviews offer unfiltered perspectives on 1Cover’s performance:

Positive Feedback

- Cruise Success: “Missed ports on my cruise, and 1Cover reimbursed me quickly after submitting proof.” (4-star review, 2024)

- Budget-Friendly: “Perfect for a cheap Bali trip—setup was easy and pricing fair.” (5-star review, 2025)

- Occasional Support Wins: “Harshitha handled my medical claim with care and professionalism.” (5-star review, 2024)

Negative Feedback

- Claim Rejections: “Lost $5,000 on a flight delay claim—1Cover said it wasn’t covered despite my documentation.” (1-star review, 2025)

- Communication Delays: “Weeks of silence after submitting claim documents, even after follow-ups.” (2-star review, 2024)

- Policy Confusion: “Exclusions for app failures weren’t clear until my claim was denied.” (1-star review, 2025)

These insights reinforce this 1Cover Travel Insurance Review’s findings: affordability is a draw, but reliability is inconsistent.

Frequently Asked Questions (FAQs)

1. Is 1Cover Travel Insurance legitimate?

Yes, it’s a registered insurer in Australia and New Zealand since 2003, backed by HDI Global Specialty SE.

2. Does 1Cover cover COVID-19-related claims?

It covers overseas medical expenses for COVID-19 but excludes cancellations or quarantine costs. Always review the PDS.

3. How long do 1Cover claims take?

Typically 10–15 business days, though delays up to 30 days occur for complex cases, per user reports.

4. Can I cancel my 1Cover policy?

Yes, a 14-day cooling-off period allows full refunds if no claims are made and travel hasn’t begun.

5. Are pre-existing conditions covered?

Up to 35 conditions (e.g., asthma, diabetes) may be covered with a medical assessment, but approval varies.

Recommendations: Who Should Choose 1Cover?

Consider 1Cover If:

- You’re seeking affordable coverage for low-risk or short trips.

- You need cruise-specific protections like missed port reimbursements.

- You value price over premium service.

Avoid 1Cover If:

- You prioritize fast, reliable claims processing and support.

- Your trip involves high-value bookings or complex medical needs.

- You require comprehensive COVID-19 coverage, including cancellations.

Final Verdict

This 1Cover Travel Insurance Review concludes that 1Cover is a budget-friendly option for travelers prioritizing cost, with plans starting at $50 and niche cruise coverage. Its 2 million customers and 20-year history add credibility. However, a 2.6/5 Trustpilot score, estimated <50% claim approval rate, and limited COVID-19 protection (medical only) raise concerns. Frequent complaints about denials and slow support further diminish its appeal.

For most travelers, competitors like Southern Cross (4.5/5, 96% claim approval) or InsureandGo (4.2/5, 92% claim approval) offer greater reliability and broader coverage. Unless your focus is strictly on price, explore these alternatives for better peace of mind.